In unpredictable South Africa, choosing the best among top Short Term Insurance (STI) Brokers is vital for individuals and businesses facing unforeseen events. These brokers offer tailored policies, accessible solutions, and stability during turbulent times, bridging clients with top STI companies. By verifying registration, evaluating product range, staff knowledge, pricing transparency, and claim settlements, you can select reliable brokers providing comprehensive protection, peace of mind, and financial security among the Top 10 STI Brokers and Companies in South Africa.

South Africans are increasingly turning to short-term insurance to protect their assets and manage risks effectively. With a growing market of brokers offering diverse coverage options, choosing the right provider can be challenging. This article explores the top 10 short-term insurance brokers in South Africa, highlighting their role in facilitating access to quality coverage. By understanding key factors and evaluating performance, reputation, and customer satisfaction, you can make an informed decision when selecting a broker for your needs.

- Understanding Short-Term Insurance: Why It Matters for South Africans

- The Role of Top Brokers: Facilitating Access to Quality Coverage

- Uncovering the Best Short-Term Insurance Brokers in South Africa

- Key Factors to Consider When Choosing a Broker

- A Closer Look at the Top 10: Performance, Reputation, and Customer Satisfaction

Understanding Short-Term Insurance: Why It Matters for South Africans

In South Africa, where unpredictable events can significantly impact individuals and businesses, Short Term Insurance (STI) plays a crucial role in providing financial security. STI offers protection against unforeseen circumstances such as accidents, natural disasters, or medical emergencies, offering peace of mind that is invaluable. It’s not just about the coverage; it’s about ensuring stability during turbulent times.

When choosing a top short term insurance broker, South Africans can look for companies that offer tailored policies to suit individual needs. The best short term insurance brokers in SA provide accessible and comprehensive solutions, helping clients navigate the complexities of STI products. By selecting one of the top 10 short term insurance companies in South Africa, individuals and businesses can be certain they’re protected against life’s unexpected twists and turns.

The Role of Top Brokers: Facilitating Access to Quality Coverage

In today’s fast-paced world, having reliable access to quality short term insurance is more important than ever for individuals and businesses in South Africa. This is where top short term insurance brokers play a pivotal role, acting as trusted guides navigating the complex landscape of coverage options. They serve as a bridge between clients and the best short term insurance companies in SA, ensuring that individuals and enterprises secure the most suitable policies to meet their immediate needs.

These leading brokers possess in-depth knowledge of the market, staying updated on the latest trends, policy offerings, and industry changes. By leveraging their expertise and connections, they facilitate easier access to top 10 short term insurance companies in South Africa, enabling clients to find tailored solutions that offer comprehensive protection without breaking the bank. This expert assistance is invaluable, especially for those new to the process or facing unique risk profiles, ensuring they receive the best possible coverage for their circumstances.

Uncovering the Best Short-Term Insurance Brokers in South Africa

In today’s digital era, navigating the complex landscape of short term insurance can feel like a daunting task for many South Africans. However, uncovering the best short-term insurance brokers in the country is not as challenging as it seems. By delving into the top 10 short term insurance brokers in South Africa, individuals and businesses alike can find peace of mind knowing they’re in capable hands. These leading companies offer a symphony of tailored solutions, ensuring that every client’s unique needs are met with precision and efficiency.

When determining the top 10 short term insurance companies in South Africa, several factors come into play. We consider their financial stability, customer service ratings, range of products, claim settlement records, and innovative use of technology. In contrast to folks who might view short-term insurance as a mere necessity, these top brokers see it as an opportunity to revolutionise the industry. They foster an environment where clients are not just numbers but valued partners, ensuring every interaction is seamless and beneficial.

Key Factors to Consider When Choosing a Broker

When selecting a short term insurance broker in South Africa, it’s crucial to consider several key factors that ensure you receive optimal service and coverage. Firstly, check if the broker is registered with the relevant regulatory bodies like the National Insurance Company (NIC) or the South African Underwriters’ Association (SAUA). This registration ensures they adhere to industry standards and consumer protection laws.

Secondly, assess their range of products and services to match your specific needs. Top short term insurance brokers in SA typically offer diverse options catering to various life stages and circumstances. Customer service is another vital aspect; look for brokers with responsive, knowledgeable staff who provide clear explanations and guidance throughout the process. Additionally, consider their pricing transparency, quick claim settlement records, and any additional value-added services they may offer, such as online policy management or financial advice.

A Closer Look at the Top 10: Performance, Reputation, and Customer Satisfaction

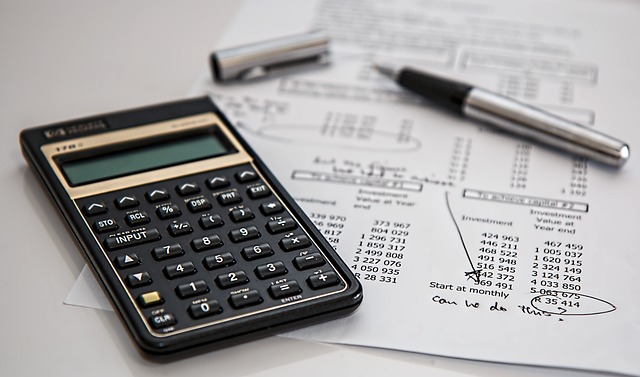

When evaluating the top short term insurance brokers in South Africa, a deep dive into their performance metrics and customer satisfaction levels is crucial. The best short term insurance brokers not only offer competitive rates but also deliver exceptional service and reliable coverage. Reputational assessment plays a significant role as well; companies with a proven track record of integrity and transparency are more likely to uphold high standards in all aspects of their operations.

Focusing on customer satisfaction, the top 10 short term insurance brokers in South Africa stand out for providing personalized solutions tailored to individual needs, along with responsive and efficient claims processes. These top short term insurance companies foster trust through clear communication, proactive engagement, and a commitment to enhancing client relationships. As a result, they consistently rank high among satisfied policyholders, solidifying their position as the go-to choice in the competitive landscape of South African short term insurance.